Gridlocked

Industrial Technology & Solutions Insights

How Increasing Unreliability of the Global Power Grid is Sparking Demand for Distributed Power Solutions

By Becca Schlagenhauf, Principal at Baird Capital

Global electricity infrastructure is showing signs of stress and that presents a rich opportunity for many different companies—from renewable energy providers to traditional fossil fuel-based generators—to step up and plug gaps in the fraying power grid with distributed power solutions.

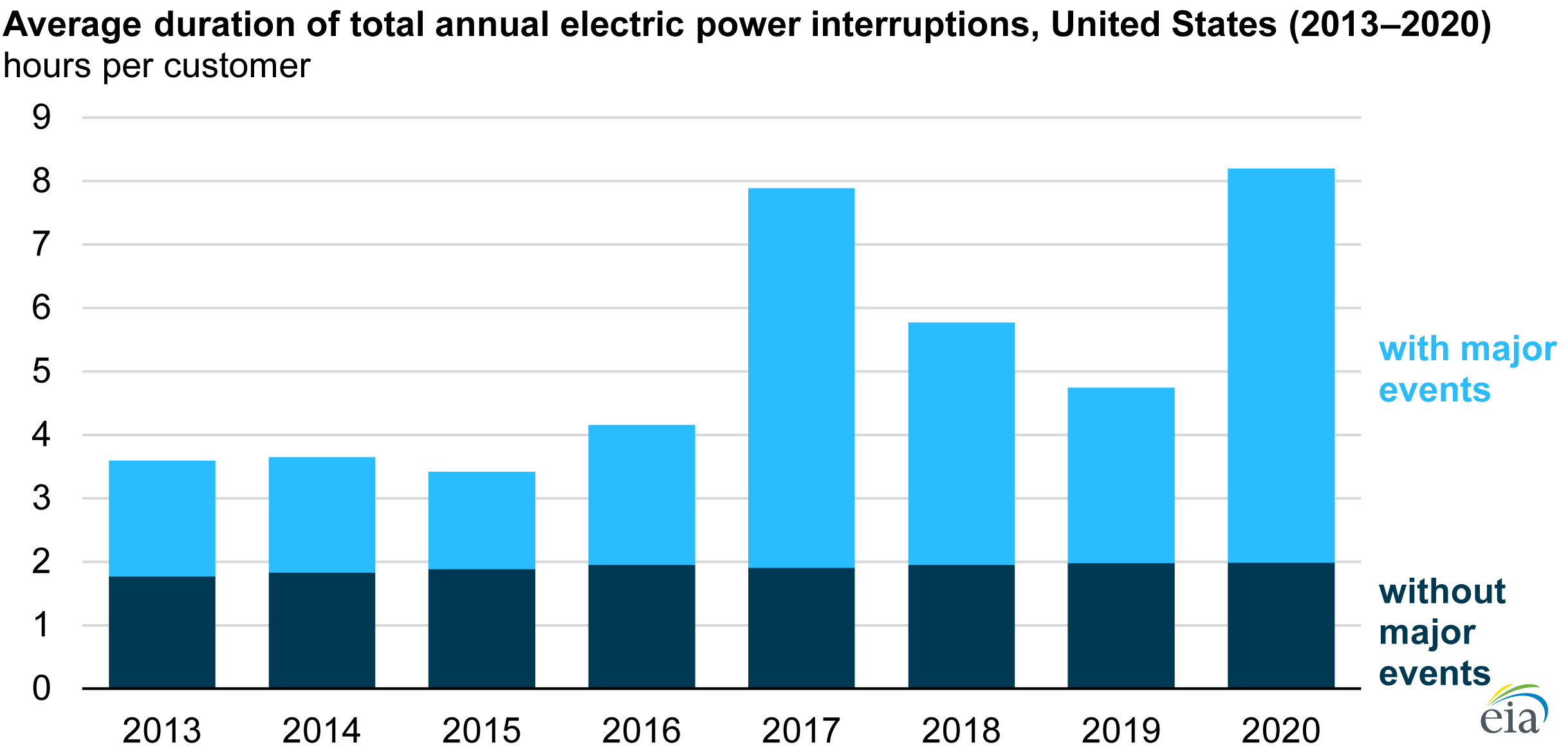

Signs of major imbalances between supply and demand in the electricity market are inescapable. Whether it’s rolling summertime brownouts in the Northeast and California, dangerous wintertime outages in Texas, or severe weather-related disruptions in the Midwest, what were once anomalous disruptions now seem to be the norm. According to The Wall Street Journal, the number of significant power disruptions in the U.S. jumped from fewer than two dozen in 2000 to more than 180 in 2020.1 The U.S. Energy Information Administration estimates that the average U.S. utility customer spent over eight hours in the dark in 2020, more than double the figure for 2013.2

Chart source: EIA. Data from U.S. Energy Information Administration, Annual Electric Power Industry Report.

The challenges aren’t confined to the U.S. Last fall, headlines warned of the difficult winter ahead for Europe—store shelves in Spain were emptied and the Austrian government urged families to keep two weeks of food on hand.3 Europeans enjoyed a brief period of relief when the winter turned out to be relatively mild, but this picture changed dramatically with the recent invasion of Ukraine by Russia. Russia supplies roughly one-third of the natural gas used by Europe. The effective cancellation of the Nord Stream 2 pipeline, which was expected to meet the growth in European energy demand for the foreseeable future, raises serious questions about where Europeans will get their power going forward.

What’s causing the instability in the grid? One factor is underinvestment in the aging infrastructure used to transmit and distribute power. According to the U.S. Department of Energy, 70% of transmission lines and large transformers are more than 25 years old, and the average age of the components in the utility infrastructure are about four decades old.4

Growing demand is also a factor. Even as buildings and machines become more efficient, economic expansion, the proliferation of data centers and the increase in electric vehicles—which alone is expected to require a doubling of generation capacity by 2050 according to NREL estimates—are all causing a long-term net increase in the demand for power.5

And finally, there is instability in the system related to the transition to green sources of energy, a tectonic shift in the energy landscape that, at a minimum, is bound to cause some dislocations before the ground settles. Fossil fuel advocates have made some far-reaching claims about the unreliability of wind, solar and hydroelectric power that are not always borne out by the data.6 What is indisputable, however, is that the move toward green energy comes at a cost today—residential electricity rates in Europe, where renewables account for more energy generation than fossil fuel sources, are roughly twice that of the U.S.—and it can cause price volatility.7

Distributed power solutions, distributed opportunities

The growth in demand and the shift to renewables are both helping to accelerate a fundamental shift in the modern power grid to a more decentralized, more flexible and more entrepreneurial approach—the distributed energy model.

Distributed energy resources, or DERs, are small-scale power resources that are connected to the electric grid. They are typically found close to load centers and “behind the meter.” In addition to serving as a primary power source to the load center, they can be used individually or aggregated into a microgrid to provide local power or to bolster the broader grid. DERs include solar arrays, small wind farms, and battery storage systems. They also include generators powered by natural gas- or diesel-fired reciprocating engines that can operate continuously or can come online during periods of high load or in a back-up capacity.

A Brookings report enumerated the benefits of distributed power: improved distribution efficiency, reduced strain on the grid during peak demand periods, greater reliability, environmental benefits, possible net job creation, region-specific benefits, and greater security of the grid as a result of decentralization of power sources.8 For all these reasons, policymakers are generally supportive of the distributed power trend and often provide generous tax incentives to support projects.

The growth potential in distributed energy has not been lost on investors. Innovation and investment are required to provide solutions to meet growing energy needs. Decarbonization will advance but will face challenges of cost and reliability. Existing infrastructure will require investment while new technologies are brought online. This will create opportunities for companies providing technology and solutions in support of this transition. At Baird Capital, we’ve been navigating the broader industrials markets for over 40 years. Our platform is global, but our roots are in the U.S. heartland, where distributed power opportunities abound. We’re actively pursuing investments in critical infrastructure solutions as well as in new sources of sustainable energy.

To learn more, contact me or a member of our Private Equity Industrial Technology team listed here.

Becca Schlagenhauf serves as Principal with Baird Capital’s Global Private Equity team. She received an MBA from the Kellogg School of Management at Northwestern University and a B.A. in economics from the University of Notre Dame. Schlagenhauf is also a CFA charterholder.